Our PPSR guide explains its impact on car financing, borrower and lender rights, detailed steps for PPSR checks, practical examples and FAQs to help anyone considering a car loan.

The PPSR and Car Finance: Understanding Your Rights and Responsibilities

Updated 19 March 2024

Summary:

-

If you're financing a car, understanding the complexities of car loans and the Personal Property Securities Register (PPSR) can be a steep learning curve.

-

This guide is published to explain the PPSR and provide essential information for both lenders and borrowers. We explain how it protects lenders through the registration of security interests, its implications for borrowers, and the risks involved in buying used cars with outstanding finance.

-

Our guide gives step-by-step instructions for conducting a motor vehicle search, comparing services like CarJam and the government's PPSR website, and looking at real-life reports for a car with money owing.

To help explain the PPSR specifically for car loans, our guide covers:

- Understanding the Personal Property Securities Register (PPSR)

- How is the PPSR Relevant to Car Loans?

- How to Use the Personal Property Securities Register if You're Buying a Car

- The PPSR in Practice and Typical Car Loan Examples

- Frequently Asked Questions

Understanding the Personal Property Securities Register (PPSR)

The PPSR is an online registry important element in New Zealand's financial and legal framework and oversees personal property transactions.

The register was established under the Personal Property Securities Act 1999 and serves several vital functions:

- Recording Security Interests: It allows lenders and businesses to register their security interests in personal property. This is not limited to vehicles but extends to various types of assets people borrow to buy (but excludes land and buildings).

- Public Access: The PPSR is accessible to the public. This transparency enables individuals and businesses to check if personal property they are interested in buying or leasing is subject to a security interest at a small cost (around $2).

- Legal Framework: The Act outlines the rules for creating and registering security interests and determines priority among competing interests.

- Risk Mitigation: By registering a security interest on the PPSR, lenders can protect themselves against the borrower going bust, ensuring their right to seize the collateral if a debtor defaults.

How is the PPSR Relevant to Car Loans?

The PPSR plays a pivotal role in safeguarding both car lenders and borrowers.

1. Protection for Lenders:

When a car is purchased through financing, lenders typically register a security interest on the PPSR. This registration is a public declaration that the lender has a financial interest in the vehicle.

If the loan later goes unpaid, the lender has the legal right to repossess and sell the car to recover the outstanding debt.

2. Importance for Borrowers:

A security registration on the PPSR confirms that the lender holds a security interest in the vehicle until the loan is fully repaid, and it can be repossessed at any time if loan repayments are missed.

Furthermore, for anyone buying a used car, a PPSR check can reveal whether the car has any existing security interests.

Many New Zealanders sell cars with finance owing - a search of the PPSR will prevent unsuspecting car buyers from inheriting someone else's debt or buying a repossessed vehicle.

3. PPSR Fee

If you're getting a car loan, you'll often see a 'PPSR fee' in your loan documents. It is a small one-off charge (usually around $5 to $10) for registering the lender's security interest.

This fee covers the administrative cost of the registration process and ensures the legal recognition of the lender's interest in the vehicle. It will be itemised in the car loan contract as a fee.

Do I need to worry about the PPSR if I buy a new car?

Generally, the concern about PPSR is more relevant when buying used cars rather than new ones. When you buy a brand-new car directly from a dealership, any previous security interests are unlikely to be registered against it, as it has not been owned or used by anyone else. Therefore, the risk of encountering issues like existing debts or repossession is minimal.

However, if you are financing the purchase of a new car through a loan, your lender will register their interest in the vehicle on the PPSR. This acts as a legal claim to the car until the loan is fully repaid. In this case, being aware of the PPSR registration is important, as it acknowledges the lender's rights in case of a loan default.

How to Use the Personal Property Securities Register if You're Buying a Car

To search the PPSR, you need to register, and once you've set up your profile, you can search for Motor Vehicles, Debtor Persons, Debtor Organisations, Aircraft and Financing Statements.

This video explains the setup and functionality. To search to see if there is debt owed on a motor vehicle, you need to follow the steps:

- Log in to the PPSR.

- From the dashboard, choose the motor vehicle search.

- Confirm that you are conducting the search for a legitimate reason (which is required by law).

- Enter your search criteria. You'll enter the vehicle's Registration Number, Vehicle Identification Number (VIN), and/or Chassis Number.

- Use a credit or debit card to pay the search fee - $2 (plus GST).

- View, email, print or download the search results.

If finance is owed, you'll get a report that looks like this, but it won't tell you how much money is owed.

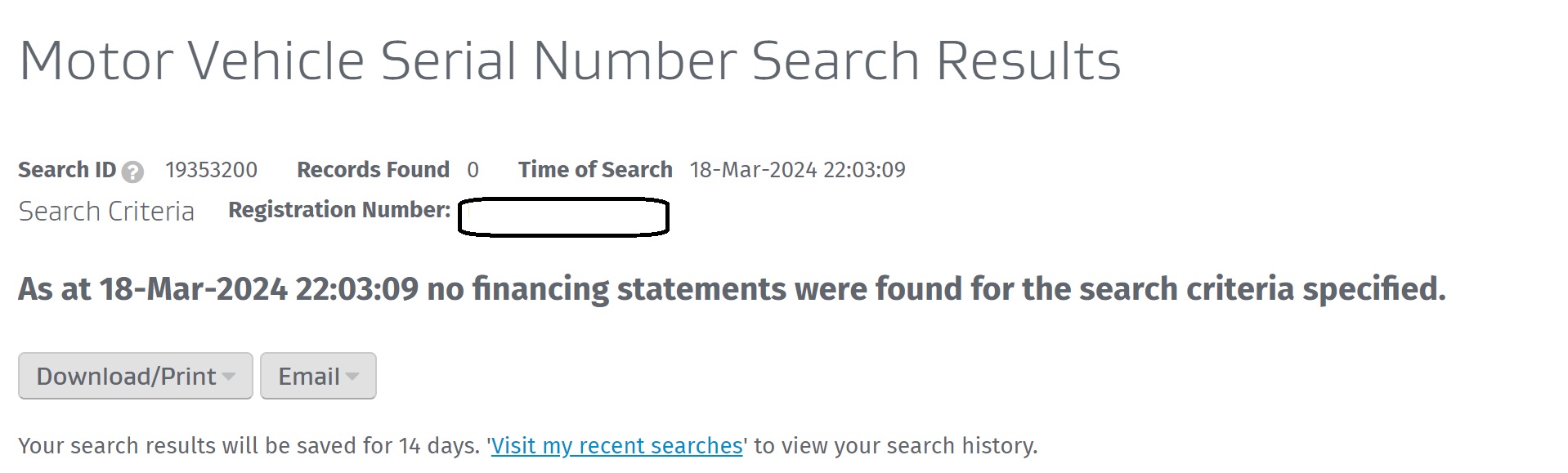

If there's no finance owing, the PPSR website will confirm this in a format like the below:

CarJam vs the PPSR - What option should I use?

- CarJam and the PPSR website both offer searches to identify if there are security interests on a car, e.g. if any finance is owed. Neither report tells you the balance of the debt.

- Both websites are quick and easy to use, although CarJam charges around 50 cents less with the same information provided.

- You can see examples of CarJam and PPSR reports for the same car search.

The PPSR in Practice - Typical Car Loan Examples

To help explain how the PPSR works we list three common scenarios:

Successful loan repayment:

- Sarah purchases a car using a loan from ZX Finance. The company registers its interest in the car on the PPSR.

- Sarah makes all her payments on time and eventually pays off the loan.

- Upon full repayment, ZX Finance discharges the security interest from the PPSR, and Sarah gains clear title to the car.

Default and repossession:

- John takes out a loan to buy a car but later faces financial difficulties and defaults.

- The lender, ABC Loans, has a registered interest in the car on the PPSR. ABC Loans repossesses the car and sells it.

- The sale proceeds go towards clearing John's debt. If the car's sale doesn't cover the full amount, any remaining debt remains John's obligation.

Buying a Used Car

- Lisa is considering buying a used car. She conducts a PPSR check and discovers an active security interest with debt owed to Big Debts Ltd.

- Lisa decides against the purchase, avoiding potential legal and financial complications given the risk of the sale price not settling the loan and the seller defaulting on their loan.

- Our guide to selling a car with finance owed explains how sellers navigate this process, but for many buyers, having finance owing can be a deal-breaker.

Frequently Asked Questions

How does a PPSR check protect someone buying a used car?

A PPSR check reveals if there are any existing security interests or debts on a used car. This helps potential buyers avoid purchasing a vehicle that could be repossessed or has outstanding finance owed.

What information is needed for a PPSR check?

To perform a PPSR check, you'll need the vehicle's registration number, VIN (Vehicle Identification Number), or chassis number. This information helps identify the specific vehicle in the registry.

What's the difference between a CarJam report and a PPSR report?

Both CarJam and the PPSR websites provide information on security interests in a vehicle. The key differences lie in the cost (CarJam is slightly cheaper) and user interface. The report content for both services is generally similar.

Can I find out how much money is owed on a car through a PPSR check?

No, a PPSR check will not reveal the exact amount owed on a car. It only indicates whether there is an outstanding security interest.

What happens when a car loan is fully repaid in relation to the PPSR?

Once a car loan is fully repaid, the lender will discharge the security interest from the PPSR, giving the borrower clear title to the vehicle.

What are the risks of buying a car with finance owing?

Buying a car with finance owing can be risky as it may lead to repossession if the previous owner defaults on their loan. It's advisable to ensure any outstanding finance is cleared before completing the purchase.

Related Guides and Resources

- The New Zealand Government's PPSR Website

- Personal Property Securities Act 1999 (the law that established the PPSR, offering legal insight and framework)

- How to Search the PPSR Guide for a Motor Vehicle

- CarJam (an alternative source of vehicle information reports, which includes data on security interests similar to the PPSR's service)